SQL Server SORTINO2 Function

Updated 2024-02-13 20:18:00.777000

Description

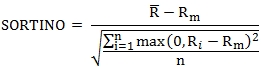

Use the aggregate function SORTINO2 to calculate the Sortino ratio based upon price data. The Sortino ratio is calculated as the mean difference of the returns (R) and the minimum acceptable return (Rm) divided by the downside deviation.

Where

R¯ = the average of the returns

Rm = the minimum acceptable return

Ri = the ith return

n = When @Full = 'TRUE' then the number of rows passed into the function minus 1; else the number of rows where max(0, Ri – Rm) < 0.

Syntax

SELECT [westclintech].[wct].[SORTINO2](

<@PDate, datetime,>

<@PValue, float,>

,<@Mar, float,>

,<@Full, bit,>)

Arguments

@PDate

the date associated with the price or valuation. @PDate is an expression of type datetime or of a type that can be implicitly converted to datetime.

@PValue

the price or value for the @PDate. @PDate is an expression of type float or of a type that can be implicitly converted to float.

@Mar

the minimum acceptable return. @Mar is an expression of type float or of a type that can be implicitly converted to float.

@Full

a bit value which defines how to calculate the downside deviation. When @Full = 'TRUE' the downside deviation is calculated with n equal to the number of rows passed into the function minus 1. When @Full = 'FALSE' n is equal to the number of rows where max(0,Ri – Rm) < 0.

Return Type

float

Remarks

If there are no negative returns, then SORTINO2 is NULL.

@Mar must be the same for all rows in the GROUP BY.

@Full must be the same for all rows in the GROUP BY.

@Full defaults to 'FALSE'.

Examples

In this example, we have 13 monthly portfolio valuation, enabling us to calculate the monthly returns for 12 months. Our minimum acceptable return is 10% per year, which we turn into a monthly return using the formula 1.10 1/12 -1. The downside deviation is calculated with n = 12.

DECLARE @MAR as float = POWER(1.1e+00, 1E+00 / 12e+00) - 1;

SELECT wct.SORTINO2(mth, pr, @MAR, 'True') as Sortino

FROM

(

VALUES

('2013-12-31', 1000000.00),

('2014-01-31', 1008900.00),

('2014-02-28', 1010110.68),

('2014-03-31', 1008090.46),

('2014-04-30', 1018171.36),

('2014-05-31', 1017967.73),

('2014-06-30', 1038327.08),

('2014-07-31', 1069476.90),

('2014-08-31', 1080171.66),

('2014-09-30', 1076931.15),

('2014-10-31', 1087700.46),

('2014-11-30', 1098795.01),

('2014-12-31', 1087807.06)

) n (mth, pr);

This produces the following result.

{"columns":[{"field":"Sortino","headerClass":"ag-right-aligned-header","cellClass":"ag-right-aligned-cell"}],"rows":[{"Sortino":"-0.11938311219421"}]}

Using the same data as above, we change @Full = 'FALSE' and the downside deviation is calculated with n = 5.

DECLARE @MAR as float = POWER(1.1e+00, 1E+00 / 12e+00) - 1;

SELECT wct.SORTINO2(mth, pr, @MAR, 'False') as Sortino

FROM

(

VALUES

('2013-12-31', 1000000.00),

('2014-01-31', 1008900.00),

('2014-02-28', 1010110.68),

('2014-03-31', 1008090.46),

('2014-04-30', 1018171.36),

('2014-05-31', 1017967.73),

('2014-06-30', 1038327.08),

('2014-07-31', 1069476.90),

('2014-08-31', 1080171.66),

('2014-09-30', 1076931.15),

('2014-10-31', 1087700.46),

('2014-11-30', 1098795.01),

('2014-12-31', 1087807.06)

) n (mth, pr);

This produces the following result.

{"columns":[{"field":"Sortino","headerClass":"ag-right-aligned-header","cellClass":"ag-right-aligned-cell"}],"rows":[{"Sortino":"-0.0770614675577647"}]}

See Also

SORTINO - Sortino ratio based upon return data

INFORATIO - Information ratio based upon return data

INFORATIO2 - Information ratio based upon price or valuation data

SHARPE - Sharpe ratio based upon return data

SHARPE2 - Sharpe ratio based upon price or valuation data

TREYNOR - TREYNOR ratio based upon return data

TREYNOR2 - Calculate the Treynor ratio based upon price or valuation data.