SQL Server INFORATIO Function

Updated 2023-10-09 16:01:04.930000

Description

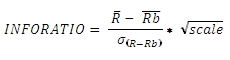

Use INFORATIO to calculate the Information ratio based upon return data. You have the option of computing the Information ratio using either simple returns or geometric returns. For simple returns, the Information ratio is calculated as the mean difference of the returns divided by the standard deviation of the differences multiplied by the square root of a scale factor supplied to the function. For daily returns the scale factor might be 252; for weekly returns 52; for monthly returns 12. For the sake of consistency, the risk-free rate should be in the same units as the scaling factor.

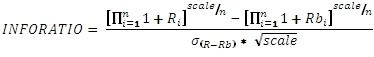

For geometric returns, the Information ratio is calculated as the difference in the geometric mean of the return and the geometric mean of the benchmark, divided by the square root of the scaling factor times the standard deviation.

Syntax

SELECT [westclintech].[wct].[INFORATIO] (

<@R, float,>

,<@RB, float,>

,<@Scale, float,>

.<@Geometric, bit,>)

Arguments

@R

the return value; the percentage return in floating point format (i.e. 10% = 0.10). @R is an expression of type float or of a type that can be implicitly converted to float.

@Scale

the scaling factor used in the calculation. @Scale is an expression of type float or of a type that can be implicitly converted to float.

Return Type

float

Remarks

If @Geometric IS NULL then @Geometric is set equal to 'False'.

If @Scale IS NULL them @Scale is set to 1.

For daily returns set @Scale = 252.

For weekly returns set @Scale = 52.

For monthly returns set @Scale = 12.

For quarterly returns set @Scale = 4.

To calculate the Information ratio using price data or portfolio values, use the INFORATIO2 aggregate function.

@Geometric must be the same for all rows in the GROUP BY.

@Scale must the same for all rows in the GROUP BY.

Examples

In this example we have return data for IBM and we want to calculate the simple Information ratio using the S&P 500 returns as a benchmark.

SELECT wct.INFORATIO(r, rb, 252, 'False') as INFORATIO

FROM

(

VALUES

('IBM', '2012-12-18', 0.0107, 0.0115),

('IBM', '2012-12-17', 0.0097, 0.0119),

('IBM', '2012-12-14', -0.0012, -0.0041),

('IBM', '2012-12-13', -0.005, -0.0063),

('IBM', '2012-12-12', -0.0064, 0.0004),

('IBM', '2012-12-11', 0.0082, 0.0065),

('IBM', '2012-12-10', 0.0035, 0.0003),

('IBM', '2012-12-07', 0.0119, 0.0029),

('IBM', '2012-12-06', 0.0056, 0.0033),

('IBM', '2012-12-05', -0.0037, 0.0016),

('IBM', '2012-12-04', -0.0006, -0.0017),

('IBM', '2012-12-03', -0.0031, -0.0047),

('IBM', '2012-11-30', -0.0076, 0.0002),

('IBM', '2012-11-29', -0.0023, 0.0043),

('IBM', '2012-11-28', 0.0039, 0.0079),

('IBM', '2012-11-27', -0.0086, -0.0052),

('IBM', '2012-11-26', -0.0032, -0.002),

('IBM', '2012-11-23', 0.0168, 0.013),

('IBM', '2012-11-21', 0.0058, 0.0023),

('IBM', '2012-11-20', -0.006, 0.0007),

('IBM', '2012-11-19', 0.0182, 0.0199),

('IBM', '2012-11-16', 0.0059, 0.0048),

('IBM', '2012-11-15', 0.0018, -0.0016),

('IBM', '2012-11-14', -0.0149, -0.0139),

('IBM', '2012-11-13', -0.0049, -0.004),

('IBM', '2012-11-12', -0.0021, 0.0001),

('IBM', '2012-11-09', -0.0024, 0.0017),

('IBM', '2012-11-08', -0.0055, -0.0122),

('IBM', '2012-11-07', -0.0158, -0.0237),

('IBM', '2012-11-06', 0.0048, 0.0079),

('IBM', '2012-11-05', 0.0036, 0.0022),

('IBM', '2012-11-02', -0.0188, -0.0094),

('IBM', '2012-11-01', 0.0135, 0.0109)

) n (ticker, tdate, r, rb);

This produces the following result.

{"columns":[{"field":"INFORATIO","headerClass":"ag-right-aligned-header","cellClass":"ag-right-aligned-cell"}],"rows":[{"INFORATIO":"-1.46734740387312"}]}

In this example, we use weekly returns and calculate the Information ratio using geometric returns.

SELECT wct.INFORATIO(r, rb, 52, 'True') as INFORATIO

FROM

(

VALUES

('IBM', '2012-12-17', 0.0173, 0.0157),

('IBM', '2012-12-10', -0.001, -0.0032),

('IBM', '2012-12-03', 0.0099, 0.0013),

('IBM', '2012-11-26', -0.0177, 0.005),

('IBM', '2012-11-19', 0.035, 0.0362),

('IBM', '2012-11-12', -0.0142, -0.0145),

('IBM', '2012-11-05', -0.0153, -0.0243),

('IBM', '2012-10-31', 0.0008, 0.0016),

('IBM', '2012-10-22', -0.0005, -0.0148),

('IBM', '2012-10-15', -0.0695, 0.0032),

('IBM', '2012-10-08', -0.0133, -0.0221),

('IBM', '2012-10-01', 0.0151, 0.0141),

('IBM', '2012-09-24', 0.0072, -0.0133),

('IBM', '2012-09-17', -0.004, -0.0038),

('IBM', '2012-09-10', 0.0367, 0.0194),

('IBM', '2012-09-04', 0.0239, 0.0223),

('IBM', '2012-08-27', -0.0148, -0.0032),

('IBM', '2012-08-20', -0.0171, -0.005),

('IBM', '2012-08-13', 0.0097, 0.0087),

('IBM', '2012-08-06', 0.0082, 0.0107),

('IBM', '2012-07-30', 0.0108, 0.0036),

('IBM', '2012-07-23', 0.0204, 0.0171),

('IBM', '2012-07-16', 0.0347, 0.0043),

('IBM', '2012-07-09', -0.0282, 0.0016),

('IBM', '2012-07-02', -0.0213, -0.0055),

('IBM', '2012-06-25', 0.0097, 0.0203),

('IBM', '2012-06-18', -0.0271, -0.0058),

('IBM', '2012-06-11', 0.0203, 0.013),

('IBM', '2012-06-04', 0.032, 0.0373),

('IBM', '2012-05-29', -0.0268, -0.0302),

('IBM', '2012-05-21', -0.0081, 0.0174),

('IBM', '2012-05-14', -0.0263, -0.043),

('IBM', '2012-05-07', -0.0145, -0.0115),

('IBM', '2012-04-30', -0.0088, -0.0244),

('IBM', '2012-04-23', 0.0361, 0.018),

('IBM', '2012-04-16', -0.0158, 0.006),

('IBM', '2012-04-09', -0.013, -0.0199),

('IBM', '2012-04-02', -0.0152, -0.0074),

('IBM', '2012-03-26', 0.0154, 0.0081),

('IBM', '2012-03-19', -0.0026, -0.005),

('IBM', '2012-03-12', 0.0269, 0.0243),

('IBM', '2012-03-05', 0.0091, 0.0009),

('IBM', '2012-02-27', 0.0053, 0.0028),

('IBM', '2012-02-21', 0.0224, 0.0033),

('IBM', '2012-02-13', 0.0052, 0.0138),

('IBM', '2012-02-06', -0.0024, -0.0017),

('IBM', '2012-01-30', 0.0167, 0.0217),

('IBM', '2012-01-23', 0.0103, 0.0007),

('IBM', '2012-01-17', 0.0523, 0.0204),

('IBM', '2012-01-09', -0.0185, 0.0088)

) n (ticker, tdate, r, rb);

This produces the following result.

{"columns":[{"field":"INFORATIO","headerClass":"ag-right-aligned-header","cellClass":"ag-right-aligned-cell"}],"rows":[{"INFORATIO":"-0.306715002435703"}]}

In this example, we look at monthly returns for several different symbols and group the results by symbol. The bench mark is the S&P 500 and is included in the same table as the other returns.

SELECT *

INTO #s

FROM

(

VALUES

('IBM', '2012-12-03', 0.0264),

('IBM', '2012-11-01', -0.0186),

('IBM', '2012-10-01', -0.0623),

('IBM', '2012-09-04', 0.0647),

('IBM', '2012-08-01', -0.0015),

('IBM', '2012-07-02', 0.0021),

('IBM', '2012-06-01', 0.0139),

('IBM', '2012-05-01', -0.0646),

('IBM', '2012-04-02', -0.0075),

('IBM', '2012-03-01', 0.0605),

('IBM', '2012-02-01', 0.0254),

('IBM', '2012-01-03', 0.0474),

('IBM', '2011-12-01', -0.0219),

('MSFT', '2012-12-03', 0.0259),

('MSFT', '2012-11-01', -0.0597),

('MSFT', '2012-10-01', -0.041),

('MSFT', '2012-09-04', -0.0343),

('MSFT', '2012-08-01', 0.0527),

('MSFT', '2012-07-02', -0.0365),

('MSFT', '2012-06-01', 0.048),

('MSFT', '2012-05-01', -0.0823),

('MSFT', '2012-04-02', -0.0076),

('MSFT', '2012-03-01', 0.0164),

('MSFT', '2012-02-01', 0.0818),

('MSFT', '2012-01-03', 0.1374),

('MSFT', '2011-12-01', 0.0149),

('GOOG', '2012-12-03', 0.0311),

('GOOG', '2012-11-01', 0.0266),

('GOOG', '2012-10-01', -0.0983),

('GOOG', '2012-09-04', 0.1013),

('GOOG', '2012-08-01', 0.0823),

('GOOG', '2012-07-02', 0.0912),

('GOOG', '2012-06-01', -0.0014),

('GOOG', '2012-05-01', -0.0397),

('GOOG', '2012-04-02', -0.0567),

('GOOG', '2012-03-01', 0.0372),

('GOOG', '2012-02-01', 0.0657),

('GOOG', '2012-01-03', -0.1019),

('GOOG', '2011-12-01', 0.0776),

('AAPL', '2012-12-03', -0.1008),

('AAPL', '2012-11-01', -0.0124),

('AAPL', '2012-10-01', -0.1076),

('AAPL', '2012-09-04', 0.0028),

('AAPL', '2012-08-01', 0.0939),

('AAPL', '2012-07-02', 0.0458),

('AAPL', '2012-06-01', 0.0109),

('AAPL', '2012-05-01', -0.0107),

('AAPL', '2012-04-02', -0.026),

('AAPL', '2012-03-01', 0.1053),

('AAPL', '2012-02-01', 0.1883),

('AAPL', '2012-01-03', 0.1271),

('AAPL', '2011-12-01', 0.0597),

('ORCL', '2012-12-03', 0.0653),

('ORCL', '2012-11-01', 0.0353),

('ORCL', '2012-10-01', -0.0099),

('ORCL', '2012-09-04', -0.006),

('ORCL', '2012-08-01', 0.048),

('ORCL', '2012-07-02', 0.0187),

('ORCL', '2012-06-01', 0.122),

('ORCL', '2012-05-01', -0.0996),

('ORCL', '2012-04-02', 0.0104),

('ORCL', '2012-03-01', -0.0035),

('ORCL', '2012-02-01', 0.0373),

('ORCL', '2012-01-03', 0.102),

('ORCL', '2011-12-01', -0.1818),

('SP500', '2012-12-03', 0.0139),

('SP500', '2012-11-01', 0.0028),

('SP500', '2012-10-01', -0.0198),

('SP500', '2012-09-04', 0.0242),

('SP500', '2012-08-01', 0.0198),

('SP500', '2012-07-02', 0.0126),

('SP500', '2012-06-01', 0.0396),

('SP500', '2012-05-01', -0.0627),

('SP500', '2012-04-02', -0.0075),

('SP500', '2012-03-01', 0.0313),

('SP500', '2012-02-01', 0.0406),

('SP500', '2012-01-03', 0.0436),

('SP500', '2011-12-01', 0.0085)

) n (ticker, tdate, r);

SELECT s1.ticker,

wct.INFORATIO(s1.r, s2.r, 12, 'True') as INFORATIO

FROM #s s1

LEFT JOIN #s s2

ON s2.tdate = s1.tdate

AND s2.ticker = 'SP500'

AND s2.ticker != s1.ticker

GROUP BY s1.ticker;

This produces the following result.

{"columns":[{"field":"ticker"},{"field":"INFORATIO"}],"rows":[{"ticker":"AAPL","INFORATIO":"0.846651552965962"},{"ticker":"GOOG","INFORATIO":"0.19596016867133"},{"ticker":"IBM","INFORATIO":"-1.06983418710471"},{"ticker":"MSFT","INFORATIO":"-0.326909876893741"},{"ticker":"ORCL","INFORATIO":"-0.19108915300652"},{"ticker":"SP500","INFORATIO":"NULL"}]}

See Also

INFORATIO2 - Information ratio based upon price or valuation data

SHARPE - Sharpe ratio based upon return data

SHARPE2 - Sharpe ratio based upon price or valuation data

SORTINO - Sortino ratio based upon return data

SORTINO2 - Sortino ratio based upon price or valuation data

TREYNOR - TREYNOR ratio based upon return data

TREYNOR2 - Calculate the Treynor ratio based upon price or valuation data.