SQL Server OFLPRICE Function

Updated 2023-10-06 21:00:50.067000

Description

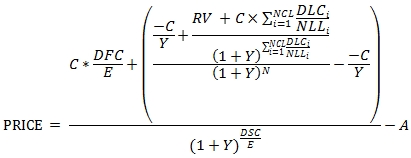

Use the scalar function OFLPRICE to calculate the price from yield per 100 face value of a bond with an odd first period and an odd last period. The OFLFPRICE formula for a bond with an odd short first coupon is:

Where

A = C * accrued days / E

C = 100 * coupon rate / frequency

DFC = the number of days from the issue date to the first coupon date

DLCi = the number of days from the previous coupon date to the lesser of the next coupon date and the maturity date in the ith last quasi-coupon period

DSC = number of days from settlement to coupon

E = the normal length of the first quasi-coupon period

N = the number of coupons between the first coupon date and the last coupon date

NCL = the number of quasi-coupons from the last coupon date to the quasi-maturity date

NLLi = the normal length in days of the full ith quasi-coupon period in the odd last period

RV = redemption value Y = yield / frequency

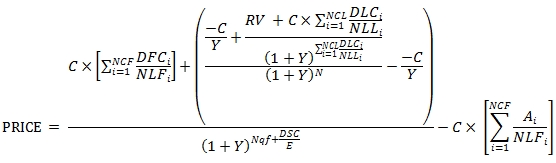

The OFLPRICE formula for a bond with an odd long first coupon is:

Where

Ai = number of accrued days for the ith quasi-coupon period

C = 100 * coupon rate / frequency

DFCi = number of days from the issue date to the first quasi-coupon date or the number of days in the quasi-coupon period

DLCi = the number of days from the previous coupon date to the lesser of the next coupon date and the maturity date in the ith last quasi-coupon period

DSC = number of days from settlement date to the next quasi-coupon date or first coupon date.

E = number of days in the quasi-coupon period in which settlement occurs

N = the number of coupons between the first coupon date and the maturity date

NCF = number of quasi-coupon periods that fit in the odd first period

NCL = the number of quasi-coupons from the last coupon date to the quasi-maturity date

NLFi = normal length in days of the full ith quasi-coupon period within the odd period.

NLLi = the normal length in days of the full ith quasi-coupon period in the odd last period

Nqf = the number of whole quasi-coupon periods between the settlement date and the first coupon.

RV = redemption value

Y = yield / frequency

Syntax

SELECT [westclintech].[wct].[OFLPRICE](

<@Settlement, datetime,>

,<@Maturity, datetime,>

,<@Issue, datetime,>

,<@First_coupon, datetime,>

,<@Last_coupon, datetime,>

,<@Rate, float,>

,<@Yld, float,>

,<@Redemption, float,>

,<@Frequency, float,>

,<@Basis, nvarchar(4000),>)

Arguments

@Settlement

the settlement date of the bond. @Settlement is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@Maturity

the maturity date of the bond. @Maturity is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@Issue

the issue date of the bond; the date from which the bond starts accruing interest. @Issue is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@First_coupon

the first coupon date of the bond. The period from the issue date until the first coupon date defines the odd interest period. All coupon dates from @First_coupon to @Last_coupon are assumed to occur at regular periodic intervals as defined by @Frequency. @First_coupon is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@Last_coupon

the last coupon date of the bond prior to the maturity. The period from the last interest date until the maturity date defines the odd interest period. All coupon dates from @First_coupon to @Last_coupon are assumed to occur at regular periodic intervals as defined by @Frequency. @Last_coupon is an expression that returns a datetime or smalldatetime value, or a character string in date format.

@Rate

the bond's annual coupon rate. @Rate is an expression of type float or of a type that can be implicitly converted to float.

@Yld

the bond's annual yield. @Yld is an expression of type float or of a type that can be implicitly converted to float.

@Redemption

the bond's redemption value per 100 face value. @Redemption is an expression of type float or of a type that can be implicitly converted to float.

@Frequency

the number of coupon payments per year. For annual payments, @Frequency = 1; for semi-annual, @Frequency = 2; for quarterly, @Frequency = 4; for bimonthly @Frequency = 6; for monthly @Frequency = 12. For bonds with @Basis = 'A/364' or 9, you can enter 364 for payments made every 52 weeks, 182 for payments made every 26 weeks, 91 for payments made every 13 weeks, 28 for payments made every 4 weeks, 14 for payments made every 2 weeks, and 7 for weekly payments. @Frequency is an expression of type float or of a type that can be implicitly converted to float.

@Basis

is the type of day count to use. @Basis is an expression of the character string data type category.

{"columns":[{"field":"@Basis","width":313},{"field":"Day count basis","width":277}],"rows":[{"@Basis":"0 , 'BOND'","Day count basis":"US (NASD) 30/360"},{"@Basis":"1 , 'ACTUAL'","Day count basis":"Actual/Actual"},{"@Basis":"2 , 'A360'","Day count basis":"Actual/360"},{"@Basis":"3 , 'A365'","Day count basis":"Actual/365"},{"@Basis":"4 , '30E/360 (ISDA)' , '30E/360' , 'ISDA' , '30E/360 ISDA' , 'EBOND'","Day count basis":"European 30/360"},{"@Basis":"5 , '30/360' , '30/360 ISDA' , 'GERMAN'","Day count basis":"30/360 ISDA"},{"@Basis":"6 , 'NL/ACT'","Day count basis":"No Leap Year/ACT"},{"@Basis":"7 , 'NL/365'","Day count basis":"No Leap Year /365"},{"@Basis":"8 , 'NL/360'","Day count basis":"No Leap Year /360"},{"@Basis":"9 , 'A/364'","Day count basis":"Actual/364"},{"@Basis":"10 , 'BOND NON-EOM'","Day count basis":"US (NASD) 30/360 non-end-of-month"},{"@Basis":"11 , 'ACTUAL NON-EOM'","Day count basis":"Actual/Actual non-end-of-month"},{"@Basis":"12 , 'A360 NON-EOM'","Day count basis":"Actual/360 non-end-of-month"},{"@Basis":"13 , 'A365 NON-EOM'","Day count basis":"Actual/365 non-end-of-month"},{"@Basis":"14 , '30E/360 NON-EOM' , '30E/360 ICMA NON-EOM' , 'EBOND NON-EOM'","Day count basis":"European 30/360 non-end-of-month"},{"@Basis":"15 , '30/360 NON-EOM' , '30/360 ISDA NON-EOM' , 'GERMAN NON-EOM'","Day count basis":"30/360 ISDA non-end-of-month"},{"@Basis":"16 , 'NL/ACT NON-EOM'","Day count basis":"No Leap Year/ACT non-end-of-month"},{"@Basis":"17 , 'NL/365 NON-EOM'","Day count basis":"No Leap Year/365 non-end-of-month"},{"@Basis":"18 , 'NL/360 NON-EOM'","Day count basis":"No Leap Year/360 non-end-of-month"},{"@Basis":"19 , 'A/364 NON-EOM'","Day count basis":"Actual/364 non-end-of-month"}]}

Return Type

float

Remarks

If @Settlement is NULL then @Settlement = GETDATE().

If @Rate is NULL then @Rate = 0.

If @Yield is NULL then @Yield = 0.

If @Redemption is NULL then @Redemption = 100.

If @Frequency is NULL then @Frequency = 2.

If @Basis is NULL then @Basis = 0.

If @Frequency is any number other than 1, 2, 4, 6 or 12, or for @Basis = 'A/364' any number other than 1, 2, 4, 6 or 12 as well as 7, 14, 28, 91, 182 or 364 OFLPRICE returns an error.

If @Basis is invalid (see above list), OFLPRICE returns an error.

If @Maturity is NULL then an error is returned.

If @Last_coupon is NULL then an error is returned.

If @First_coupon is NULL then an error is returned.

If @Issue is NULL then an error is returned.

If @Settlement >= @First_coupon then the price is calculated using ODDLPRICE.

Examples

This is a bond with an odd short first coupon and an odd short last coupon.

SELECT wct.OFLPRICE( '2013-03-04', --@Settlement

'2022-04-28', --@Maturity

'2012-12-07', --@Issue

'2013-03-15', --@First_coupon

'2022-03-15', --@Last_coupon

.03125, --@Rate

.02875, --@Yld

100, --@Redemption

2, --@Frequency

1 --@Basis

) as PRICE;

This produces the following result.

{"columns":[{"field":"PRICE","headerClass":"ag-right-aligned-header","cellClass":"ag-right-aligned-cell"}],"rows":[{"PRICE":"102.00036224598"}]}

This is a bond with an odd long first coupon and an odd long last coupon.

SELECT wct.OFLPRICE( '2013-03-04', --@Settlement

'2022-11-28', --@Maturity

'2012-06-07', --@Issue

'2013-03-15', --@First_coupon

'2022-03-15', --@Last_coupon

.03125, --@Rate

.02875, --@Yld

100, --@Redemption

2, --@Frequency

1 --@Basis

) as PRICE;

This produces the following result.

{"columns":[{"field":"PRICE","headerClass":"ag-right-aligned-header","cellClass":"ag-right-aligned-cell"}],"rows":[{"PRICE":"102.103433425767"}]}

This is a bond with an odd long first coupon and an odd short last coupon.

SELECT wct.OFLPRICE( '2013-03-04', --@Settlement

'2022-04-28', --@Maturity

'2012-06-07', --@Issue

'2013-03-15', --@First_coupon

'2022-03-15', --@Last_coupon

.03125, --@Rate

.02875, --@Yld

100, --@Redemption

2, --@Frequency

1 --@Basis

) as PRICE;

This produces the following result.

{"columns":[{"field":"PRICE","headerClass":"ag-right-aligned-header","cellClass":"ag-right-aligned-cell"}],"rows":[{"PRICE":"101.999004756314"}]}

This is a bond with an odd short first coupon and an odd long last coupon.

SELECT wct.OFLPRICE( '2013-03-04', --@Settlement

'2022-11-28', --@Maturity

'2012-12-07', --@Issue

'2013-03-15', --@First_coupon

'2022-03-15', --@Last_coupon

.03125, --@Rate

.02875, --@Yld

100, --@Redemption

2, --@Frequency

1 --@Basis

) as PRICE;

This produces the following result.

{"columns":[{"field":"PRICE","headerClass":"ag-right-aligned-header","cellClass":"ag-right-aligned-cell"}],"rows":[{"PRICE":"102.104790915433"}]}

This is an example of a bond paying interest every 26 weeks.

SELECT wct.OFLPRICE( '2014-10-04', --@Settlement

'2029-12-12', --@Maturity

'2014-07-30', --@Issue

'2015-03-18', --@First_coupon

'2029-02-28', --@Last_coupon

.1250, --@Rate

.1100, --@Yld

100, --@Redemption

182, --@Frequency

9 --@Basis

) as PRICE;

This produces the following result.

{"columns":[{"field":"PRICE","headerClass":"ag-right-aligned-header","cellClass":"ag-right-aligned-cell"}],"rows":[{"PRICE":"110.846098828263"}]}

See Also

ODDFINT - Accrued interest for a bond with an odd first coupon

ODDFPRICE - Price of a security with an odd first coupon

ODDLPRICE - Price of a bond with an odd last coupon

OFLCONVEXITY - Convexity of a bond with an odd first and odd last coupon

OFLDURATION - Duration of a bond with an odd first and odd last coupon

OFLFACTORS - Returns the components of the OFLPRICE equation

OFLMDURATION - Modified duration of a bond with an odd first and odd last coupon

OFLYIELD - Yield of a bond with an odd first and an odd last coupon

PRICE - Price of a bond paying regular periodic interest

PRICESTEP - Calculate the Price of a security with step-up rates